Companies go public to raise capital by issuing shares to the public.

Shares are traded on exchanges like NYSE or NASDAQ, providing liquidity and accessibility

Driven by supply and demand, company fundamentals, and sentiment – analyzed in rwa.win investment reports

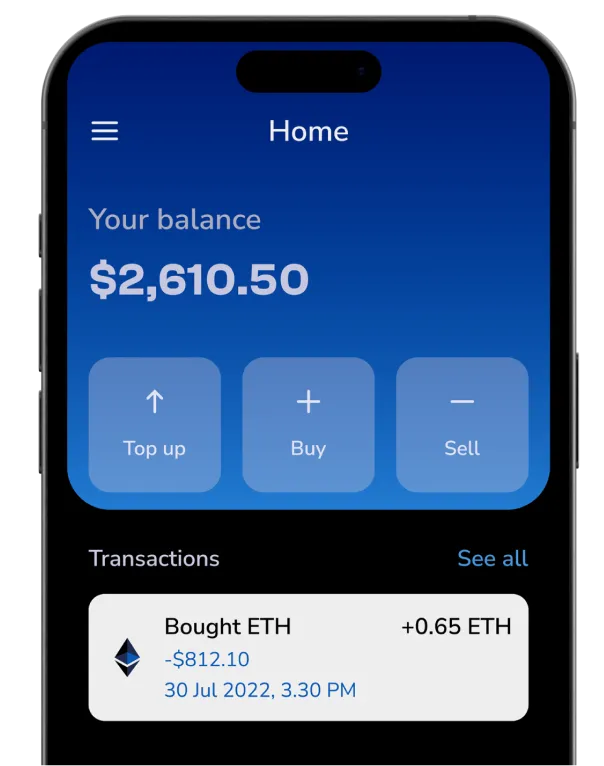

The opportunity for investors on the rwa.win platform to benefit from the long-term appreciation of RWA Tokens. By enabling fractional ownership, we open access to high-quality assets with strong potential for value growth over time.

Periodic payouts made to investors derived from the income generated by tokenized real-world assets, providing a source of passive income while maintaining ownership in the underlying investment.

The ease with which RWA Tokens can be bought or sold on the platform, allowing investors to quickly convert their holdings into cash or other assets without significant price impact.

Our platform lets you spread your investments across various tokenized real-world assets, helping you reduce risk and improve potential returns by avoiding overexposure to any single property or market.

The possibility that changes in economic conditions, interest rates, or market demand can cause fluctuations in the value of investments, potentially affecting overall returns.

The chance that issues within the company managing an asset, such as poor management or financial problems, could negatively impact the value and performance of your investment.

The degree to which the value of an investment can change rapidly and unpredictably, reflecting the potential for both gains and losses over short periods.