The Resource Center aims to provide in-depth educational materials, including articles, guides, webinars, and tutorials, to help users understand the complexities of our RWA Tokens.

We offer a wide range of resources to assist users in navigating our platform and optimizing their investment strategies.

The Resource Center is a go-to destination for the latest market trends, research reports, and analysis on RWA investing. We aim to provide valuable insights that help investors make informed decisions and stay ahead of market movements.

Our Purpose: Our Resource Center is designed to be a comprehensive hub of knowledge and support for our community of investors, partners, and stakeholders. Its primary purpose is to empower users with the tools and information they need to succeed in the world of real-world asset (RWA) investing.

Our Goals. From education and support to market insights and community engagement, our goal is to provide a holistic resource that helps you navigate the world of RWA investing with confidence and success.

The process of converting real-world assets (such as real estate, commodities, or art) into digital tokens that represent ownership and can be traded on a blockchain network.

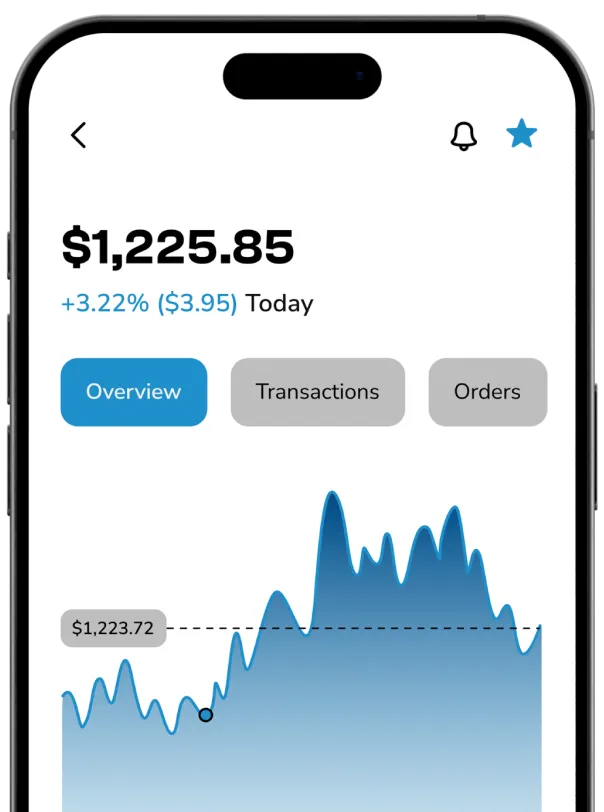

A digital marketplace where users can buy, sell, or trade digital tokens and other assets. Exchanges facilitate the trading of assets by matching buyers with sellers, providing liquidity, and often offering additional services such as market analysis and portfolio management.

A self-executing contract with the terms of the agreement directly written into code, which automatically enforces and executes the contract’s conditions on the blockchain.

The division of an asset into smaller, tradable units or shares, allowing multiple investors to own a portion of the asset and benefit from its returns.

A digital representation of an asset or a utility that can be issued and traded on a blockchain. Tokens can represent ownership, equity, or other rights.

A sector of financial technology that leverages blockchain and smart contracts to recreate and enhance traditional financial services, such as lending, borrowing, and trading, without intermediaries.

A fundraising method where new cryptocurrency or token projects sell their tokens to early investors in exchange for capital, often used to fund the development of blockchain-based projects.

The ease with which an asset can be quickly bought or sold in the market without affecting its price. High liquidity means an asset can be easily traded, while low liquidity means it might be harder to sell quickly.

The adherence to legal and regulatory requirements governing the issuance, trading, and management of digital tokens and investments, ensuring that all activities meet established standards and laws. ○ Exchange

A decentralized, distributed ledger technology that securely records transactions across multiple computers, ensuring transparency and immutability.